- Visual Brunch

- Posts

- BlackRock’s $12.5 Trillion Flex

BlackRock’s $12.5 Trillion Flex

But One Mega Withdrawal Just Shook the King of Asset Managers

A quick sip before we dive in...

Visual Brunch is officially growing up. 🥐✨

What started as the Sunday visual edition of The Latte is now its own standalone newsletter and brand. Why? Because so many of you loved it, shared it, and told us it deserved its own space.

Nothing’s changing about what you love — beautiful charts, bite-sized business stories, and market visuals every weekend.

(P.S. It now drops every Saturday — so your weekend brunch gets even better.)

Now, let’s jump into this week’s top stories:

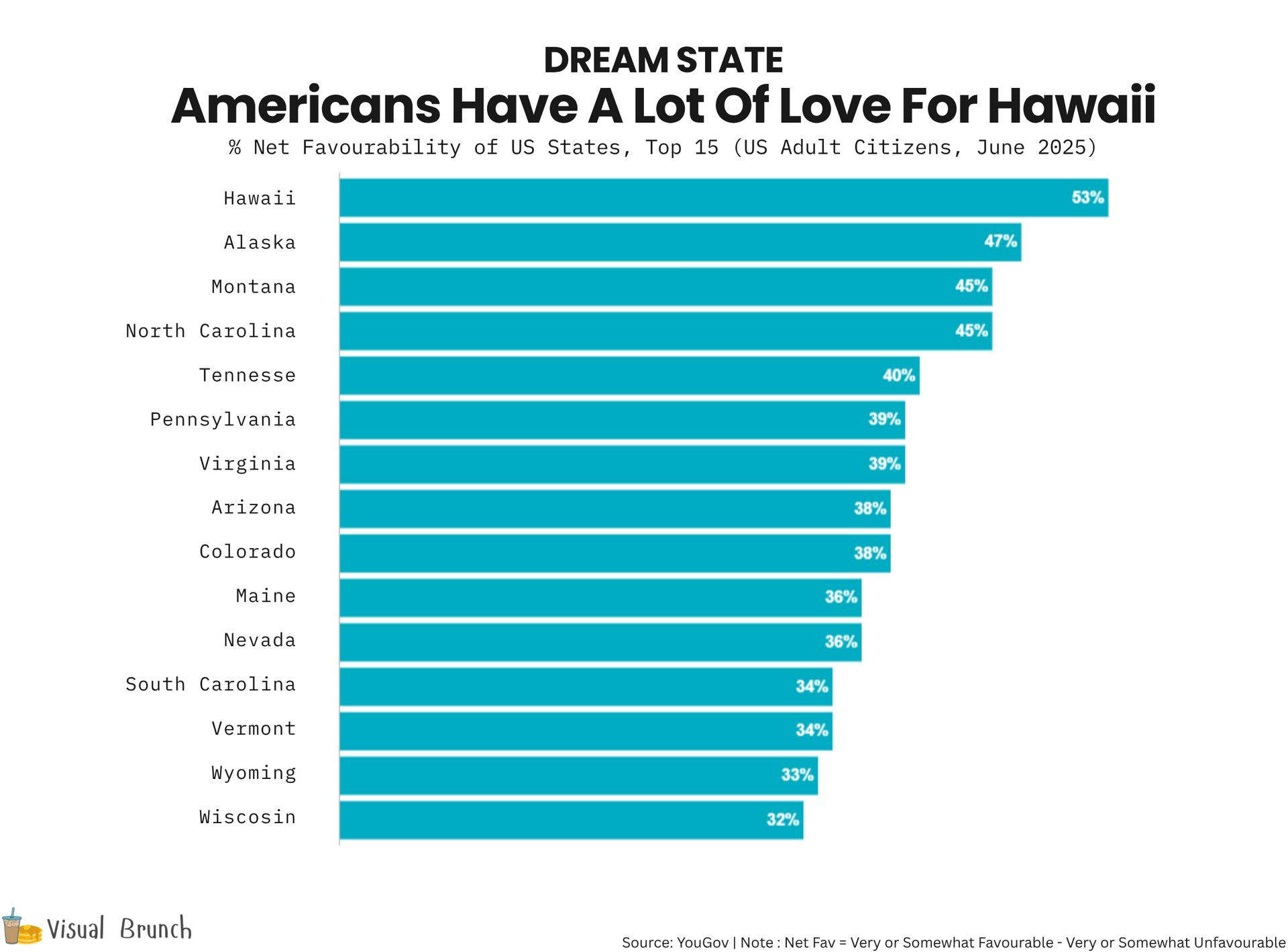

Hawaii Tops the Charts Again: A new poll crowns Hawaii as America’s most loved state, leaving D.C. at the bottom.

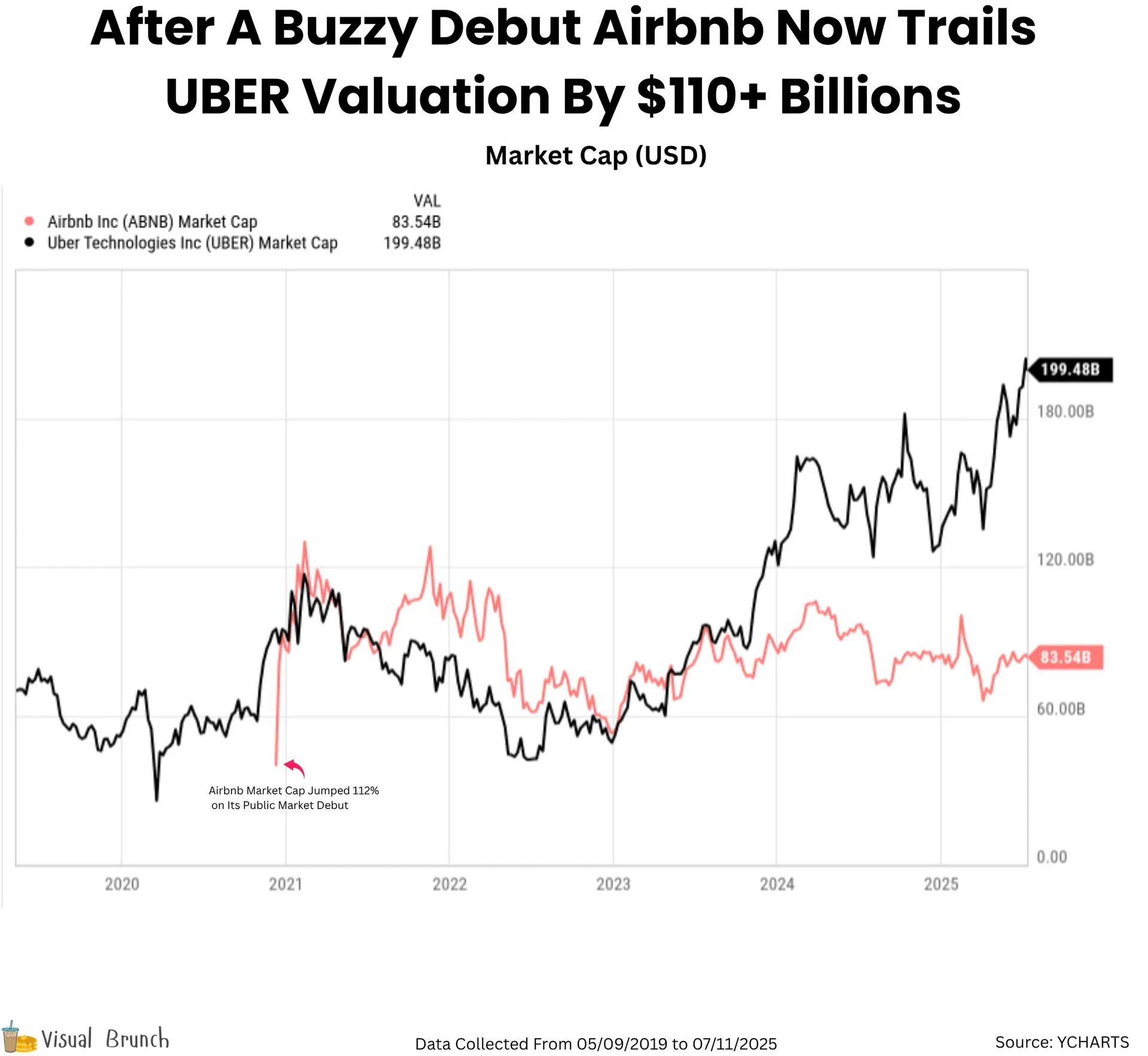

Uber vs. Airbnb: Uber’s $42.8B bookings crush Airbnb’s slow “experiences” play.

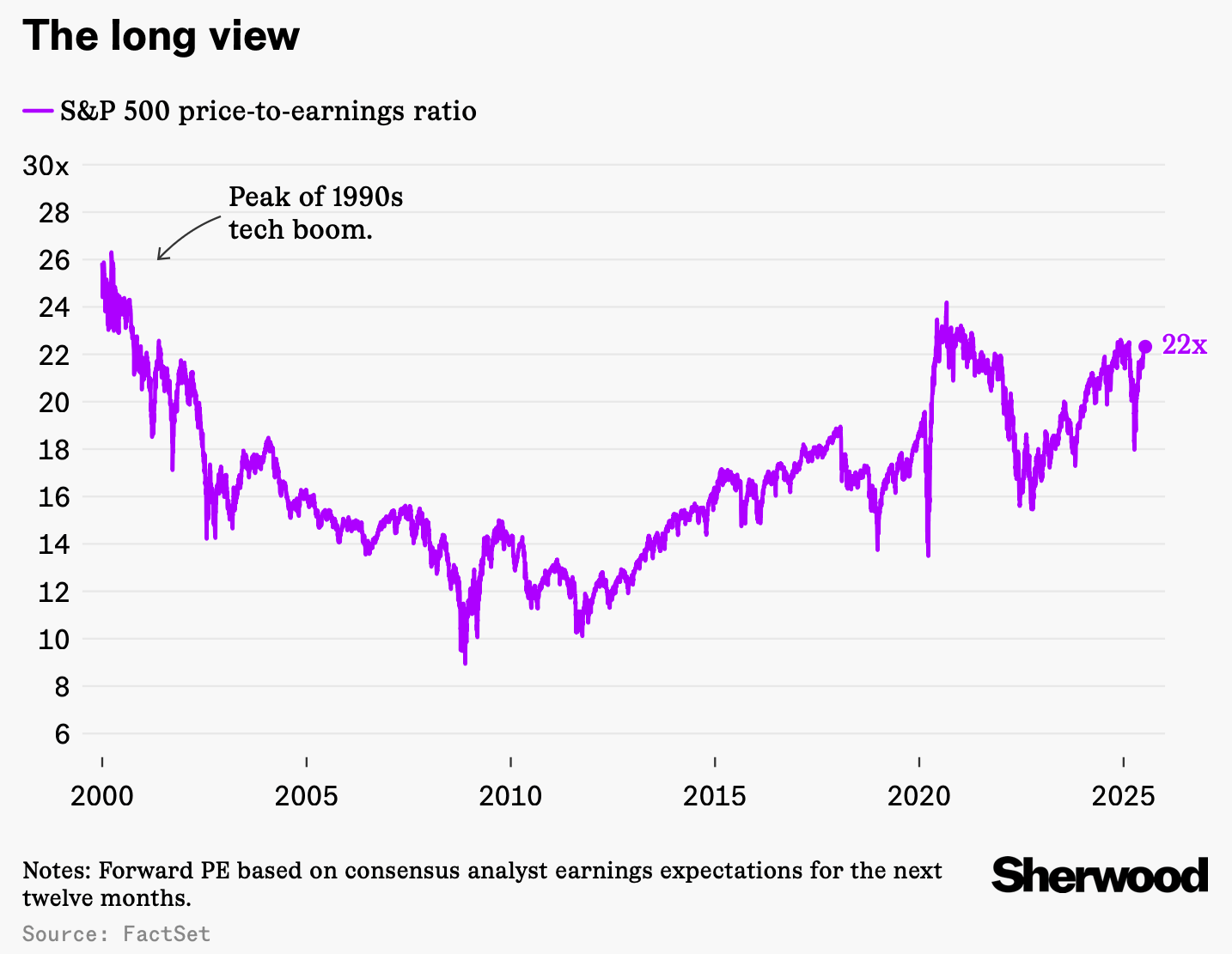

Valuations Revisit Covid Boom Levels: The S&P 500’s forward P/E ratio jumps past 22x, echoing 2021’s hype cycle.

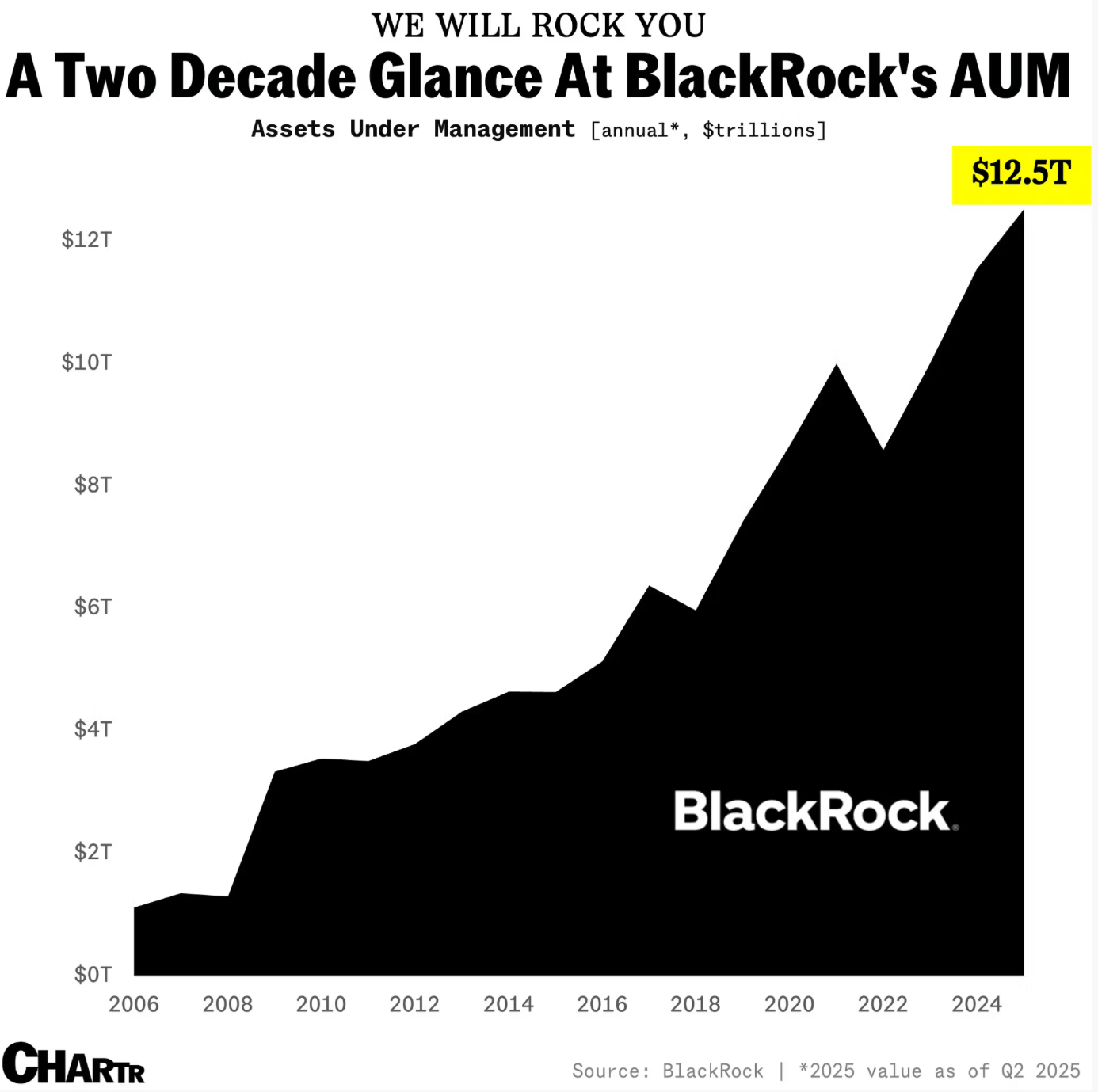

BlackRock Hits $12.5T AUM: But a $52B client withdrawal puts a dent in the celebration.

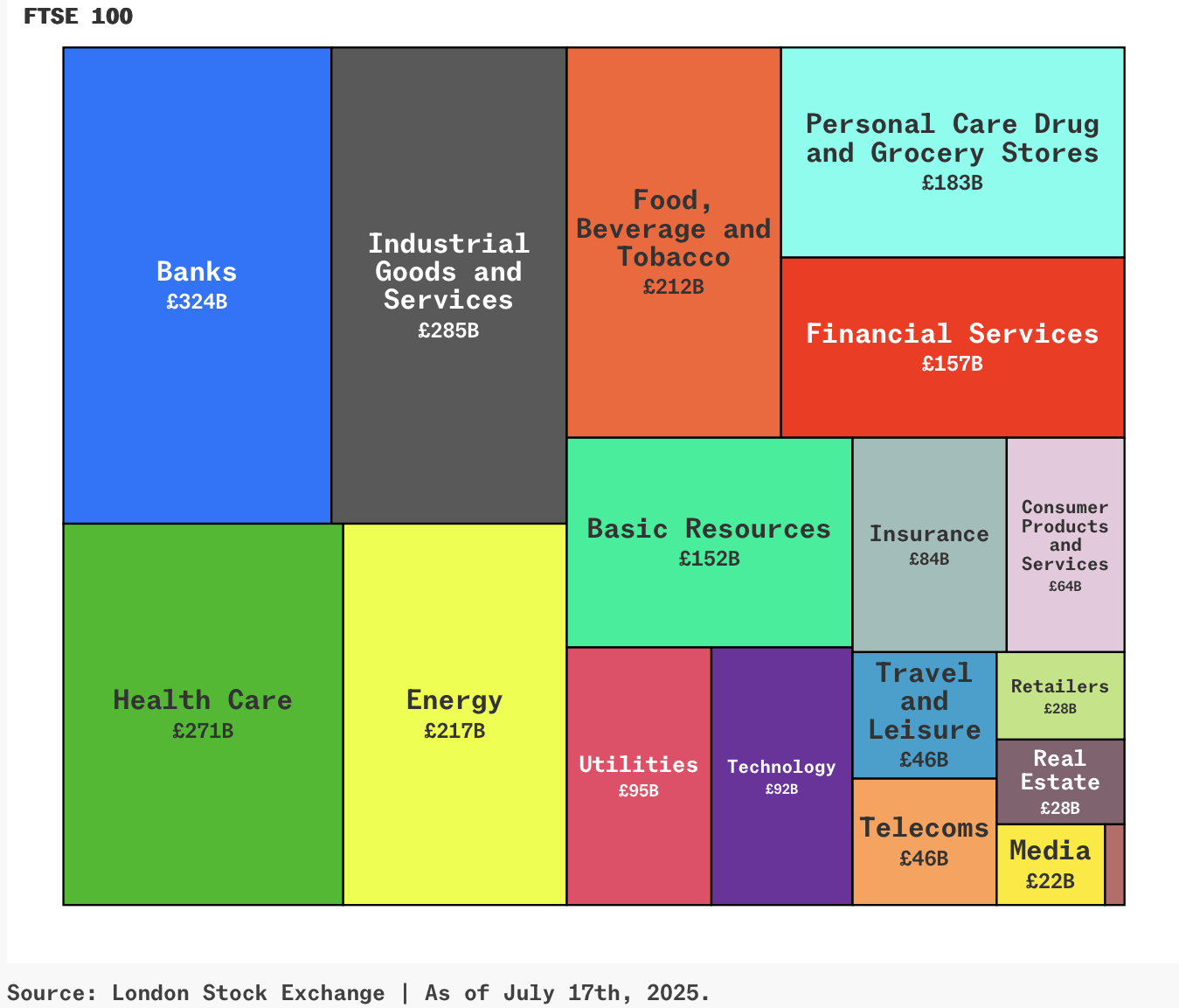

FTSE 100 Smashes 9,000 Points: UK’s “Jurassic” index beats the S&P 500, driven by defense and energy stocks.

Aloha Always Wins

Apparently, everyone agrees on one thing: Hawaii slaps. 🏖️😎

A new YouGov poll found that 68% of Americans view the Aloha State favorably — making it the most liked state in the country (again). Alaska came in second, despite only 12% of Americans having ever been there. 🐻✈️

Turns out the further away a state is, the more Americans seem to love it. Meanwhile, Washington D.C. scored last in the poll — ouch. 😬

Beaches, volcanoes, and a little Aloha go a long way.

One App Leveled Up. The Other Made a Tour Guide

Airbnb $ABNB ( ▼ 1.36% ) and Uber $UBER ( ▲ 0.83% ) were once Web 2.0 twins. But while Uber stock hits new highs, Airbnb seems stuck in neutral. 📉🛏️

Uber’s pivot into food delivery and logistics — plus its AI-adjacent Waymo collab — has paid off big, with $42.8B in Q1 bookings. Airbnb? Just $2.3B in revenue on a much lower take rate, despite efforts to diversify into “experiences” like private chefs and massages. 🍽️💆♂️

It’s not that Airbnb isn’t evolving — it’s just evolving more like a vacation… slowly.

Covid Boom Valuations Are Back

The S&P 500’s forward P/E ratio just climbed above 22x, a level we haven’t seen since the 2021 stimulus-fueled boom — and before that, the dot-com bubble. 😳

Traders are piling into “story stocks” like Aeva $AEVA ( ▼ 2.79% ) (up 500% YTD despite 4 straight quarters of losses) and OptimizeRx $OPRX ( ▼ 3.32% ) , betting on hype around AI, crypto, and tech narratives rather than fundamentals.

Strategists warn the rally looks pricey — Bank of America $BAC ( ▼ 4.72% ) flagged small caps as “back to expensive,” and Deutsche Bank sees “pockets of exuberance.” But retail dip-buying remains relentless, keeping the market flying. 🚀

$12.5 Trillion — and Falling?

BlackRock $BLK ( ▼ 2.48% ) just crossed a mind-boggling $12.5 trillion in assets under management — thanks to a surging S&P 500 and a weaker dollar. 📈💼

But the milestone wasn’t enough to keep investors happy. Shares dropped 5% on Tuesday after a massive $52B withdrawal from a single institutional client dented deposits. Ouch.

Now, CEO Larry Fink’s eyeing private markets (think private credit and loans to companies) as the next growth lever, with plans to attract $400B into higher-margin private capital by 2030.

Jurassic Stocks, Record Highs

Britain’s FTSE 100 surged past the 9,000-point mark this week, up 10% YTD and outperforming the S&P 500’s 6%. Not bad for an index once dubbed the “Jurassic Park” of stocks. 🦖📈

The FTSE’s heavyweights? AstraZeneca $AZN ( ▲ 2.19% ) ($217B), HSBC ($214B), and Shell $SHEL ( ▲ 2.87% ) (~$206B). Defense names like BAE Systems and Rolls-Royce are soaring 60%+ this year, boosting the index’s $3T value.

Despite its old-school vibe — finance, energy, and defense dominate — investors are loving its stability amid global trade and tariff turbulence.